Home » Why Are Hospital Bills So Expensive?

Why Is My Hospital Bill So Expensive?

The cost of US healthcare is soaring. Elements that contribute to the high cost of medical bills include surprise medical bills, administrative costs, rising doctors’ fees, the high cost of surgical procedures and diagnostic tests, and soaring drugs costs.

Explore our guide to discover why your medical bills are so high, the types of different health insurance plans, and advice for negotiating hospital bills.

Table of Contents

- Why Is Healthcare So Expensive?

- Why Are Medical Bills So High?

- 4 Types of Healthcare Insurance Plans

- Reducing the Cost of Your Hospital Bills

- How to Negotiate Medical Bills

- What Happens When a Medical Bill Goes to Collections?

- Glossary of Medical Billing Terms

- Frequently Asked Questions About Expensive Hospital Bills

Why Is Healthcare So Expensive?

Americans will spend in excess of $4 trillion (1) on healthcare in 2021, equating to over $12,000 for every person in the country. That figure is expected to rise to $6 trillion by 2028. US healthcare spending is twice as high when compared to other wealthy nations.

For many Americans, the cost of hospital bills is too expensive, even for those who are insured. People who are uninsured are more likely to incur medical debt, but insured patients still receive unexpected medical bills that are too high, due to deductibles, copays, coinsurance, and surprise billing or balance bills.

Why Are Medical Bills So High?

Pricing factors vary between hospitals and are determined by individual health, the cost of surgical procedures, operating room and post-surgical costs, X-rays and diagnostic tests, and doctor bills. Administrative costs also account for at least 25 percent (2) of healthcare costs (or $1 trillion per year of total healthcare spending). A RAND Corporation report found that prescription drug prices in the US are on average 256 percent higher when compared to 32 other countries.(3)

Hospital medical billing causes significant financial problems for patients. While most people have healthcare insurance, medical debt is a major problem in the US and many people can’t pay medical bills.

One out of six Americans(4), or around 18 percent of the population, were being pursued by collection agencies for medical debt in June 2020. A further study found that two-thirds of bankruptcies are linked to medical issues (5).

The average cost for hospitalized Covid-19 patients without health insurance is $73,300 (6).

Cost Comparisons

High medical bills: Cost comparisons for some common procedures show the gap between the US and other wealthy countries.

- MRI Scan: Between $1,110-$3,031 – compared to next highest in New Zealand at $811.

- Hip Replacement: $29,067-$57,225, about $10,000 higher than the next highest in Australia.

- Prescription Drugs: Avastin $3,930-$8,831 in the USA – only $470 in UK.

4 Types of Health Insurance Plans

The four most common types of health insurance plans (7)are:

- Preferred Provider Organization (PPO) – The most common plan for employers. Medical care must be provided by doctors or hospitals on their insurer’s list

- Health Maintenance Organization (HMO) – Healthcare is offered through a network of providers contracted with the HMO.

- Exclusive Provider Organization (EPO) – A managed care plan. Services are only covered if patients use hospitals and doctors in-network.

- Point of Service (POS) – POS plans charge less for patients using health care providers within the network.

Reducing The Cost of Your Hospital Bills

Our Survey: Itemized Hospital Bill insights

We surveyed 230 participants across the US about their experiences and challenges with medical bills. Here are the results of our questionnaire, with insights that may help to reduce your medical costs.

Types of Health Insurance Plans

33.5% of inpatient admissions had an HMO plan; 33.5% of inpatient admissions were on a PPO plan; 3% were on an EPO; 4% on POS; 4% on HDHP; 17% on Other and 5% had no coverage.

Itemized Bills

31% of inpatient admissions requested for an itemized bill, while 33% have not requested an itemized bill; 13% didn't know one could be requested and 2% werent' familiar with one. Another 13% of inpatient visitors didn't feel it was necessary to request one and 23% don't always ask for one though they are familiar with them.

Surprise Billing

63% of inpatient admissions experienced a surprise (out-of-network) hospital bill; while 37% had not.

Travel Insurance

Inpatient admissions saw 27% visitors who were injured while on vacation, while only 14% of them had travel insurance.

Bill Negotiation

Approx. 39% of inpatient visitors attempted negotiating a hospital bill, with 28% reporting as successful. Approx. 61% of inpatient visitors have never attempted negotiating a bill, with 32% approx. not aware a hospital bill could be negotiated.

Medical Bill Collections

Approx. 55% of inpatient visitors had medical bills go to collections, with 8% reporting wages garnished or a lien on property. Approx. 45% of inpatient visitors did not have medical bills in collections

Itemized Bill for Hospital Costs

- Around one in five (20%) respondents were unfamiliar with itemized hospital bills.

- 13% did not know they could request one.

- One-third (33%) did not know they had access to an itemized invoice.

- Over half of patients are familiar with itemized bills, although they may not feel it is necessary to ask for one (25%) or they don’t always ask for an itemized invoice (22%).

- One in five (21%) ALWAYS ask for one.

Not long ago I broke a bone in my hand. I went to the ER and they confirmed it was broken and wrapped my hand in a splint. Weeks later I received a bill for around $2000. I thought the bill was outrageously overpriced. For several months I refused to pay it. They kept sending me the bill. The last one I opened said they would send it to collections but the amount billed was much less around $700 I believe. I ended paying it because although still high it seemed much more reasonable and I did not want it to affect my credit. Moving forward I will always ask for an itemized bill.

Survey Respondent

What Is an Itemized Bill?

An itemized bill is the document that details the costs for all of the treatment and medical charges you receive as a patient. This includes doctors’ fees and charges for an inpatient stay. Every item is listed with a detailed description and price.

Consumers are not always aware that hospital bills can contain errors, which is why it’s important to ask for an itemized invoice.

Examples of errors in hospital medical bills include:

- Incorrect insurance information

- Duplicate billing

- Charges for services you didn’t receive and medications you didn’t take

- Incorrect billing for time spent in the OR/operating theater

- Simple math errors resulting in an incorrect bill total

Your itemized bill should contain a list of procedures, with a brief description and a five-digit billing code. The Centers for Medicare and Medicaid Services has a code searching tool(8). Are the dates and providers correct? Have you been billed for an out-of-network provider?

Surprise Medical Bills

How To Negotiate Medical Bills

Medical debt is a serious problem for Americans, but getting your medical bills reduced is possible. Negotiating hospital bills can reduce your overall medical debt. In some cases, you may be eligible for medical debt forgiveness or medical debt relief.

Our survey found that:

- 34% of respondents did not know that hospital bills could be negotiated

- 31% were aware they can negotiate but have never attempted to do so

- 27% have successfully negotiated a hospital bill cost

- 9% had tried but were unsuccessful

- 65% of respondents have never attempted hospital bill negotiation.

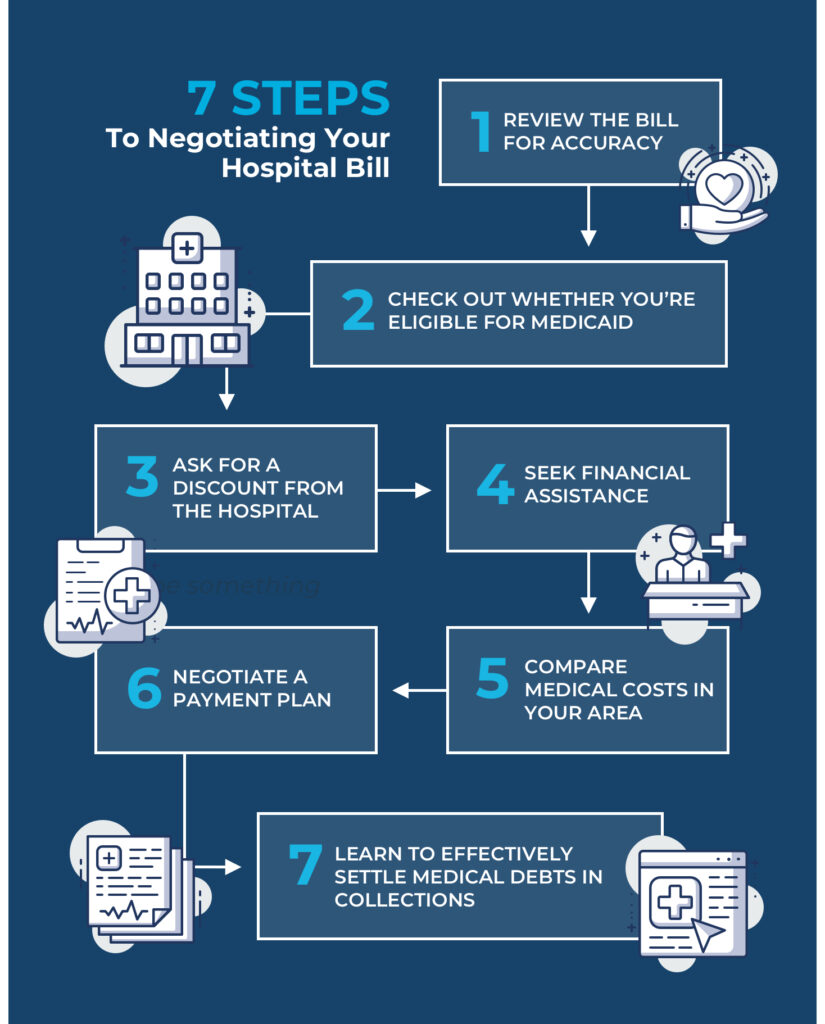

7 Steps To Negotiating Your Hospital Bill

- Review the bill for accuracy: Ask for an itemized bill to ensure you are being billed correctly for your procedure.

- Check out whether you’re eligible for Medicaid: Medicaid coverage is retroactive in some states and can cover up to three months of medical bills.

- Ask for a hospital discount: Some hospitals offer discounts or medical debt forgiveness if you can show evidence of financial hardship. If you’re uninsured, ask to pay the Medicare rate.

- Seek financial assistance: Find out if you qualify for charity care or financial assistance programs. Federal law requires nonprofit hospitals and most health centers to determine a patient’s eligibility for financial assistance and how much they can be charged.

- Compare costs in your area: Websites such as Healthcare Cost and Utilization Project and the Healthcare Bluebook provide comparable price data for hospitals in your area. File an appeal if you can’t pay.

- Negotiate a payment plan: Don’t put the bill on a credit card unless you can pay it promptly as credit cards charge high-interest rates. Healthcare provider payment plans for medical debts are usually interest-free. If monthly payments are too high, don’t be afraid to ask for a lower repayment amount.

Your Hospital Bill

- Review the bill for accuracy

- Check out whether you’re eligible for Medicaid

- Ask for a hospital discount

- Seek financial assistance

- Compare costs in your area

- Negotiate a payment plan

What Happens When A Medical Bill Goes To Collections?

Medical debt happens when unpaid medical bills are sent to collections. Don’t ignore these bills. Keep communications open and take steps to negotiate your hospital bill where possible.

The Pathway from Medical Bill to Medical Debt Collections

Medical visit/treatment: Patient incurs medical costs not covered by insurance.

Unpaid medical bill: Medical debt remains unpaid.

Bill past due: Healthcare providers usually expect payment within 90-180 days before taking steps to recover the medical debt when a bill is past due.

Medical debt: If a medical bill remains unpaid, a healthcare provider will try to collect the outstanding money through collectors or directly from the patient in-house.

Medical debt goes to collections: Unpaid medical bills can be turned over to debt collectors, to a debt buyer, or the debt can be written off as a business loss.

Credit Reports: After 180 days medical debts are displayed on credit reports.

Survey Results for Bills Sent to Collections

- Over a third (36%) have experienced medical bills going to collections.

- 6% of respondents even experienced wages garnished or a lien against their property.

I was a young mother of two and had to have surgery. I was the only person working. While out on medical leave, my paychecks were half my wages. I still had to pay FULL daycare, rent, car insurance, gas & electric, water, and groceries. I couldn’t pay what was left after insurance kicked in. I ended up filing for bankruptcy.

Survey Respondent

How to Settle Medical Debt in Collections

When your medical debt goes to collections it can be stressful if you’re receiving calls and letters from collection agencies. Consider the following tips on how to settle medical debt in collections.

Verify your debt: Confirm all details and data on your medical bill are correct, including the total amount outstanding and the name of the creditor (the doctor’s office or the healthcare facility/hospital that treated you).

Confirm all discussions and communications in writing. Under the Fair Debt Collection Practices Act (FDCPA)(9) you have the right to demand collections agencies only contact you in writing or cease contact altogether.

Confirm with your insurance company whether you still owe money to the hospital. If the amount your hospital states you owe is different from what your insurance company says, this indicates a potential error on your bill.

Contact the collection agency to negotiate payment arrangements. Some collection agencies may offer a settlement amount. A settlement may reflect negatively on your credit score because you have not settled the full amount.

Consider working with a Medical Billing Advocate to fight a bill that’s in collection. Before taking this step, understand how they are paid and check out the successful cases they have resolved.(10)

Glossary of Medical Billing Terms

Co-pay: A fixed amount paid for a health service covered by your insurer after your deductible is paid. This includes, for instance, seeing a specialist, visiting a doctor or ER or when purchasing prescription drugs.

Coinsurance: Coinsurance is the percentage patients pay after meeting their deductible.

Collections: Debt collections are typically handled by third-party collection agencies with the aim of pursuing payments from individuals and companies that have accrued debt with healthcare providers and the original creditors.

Insurance Deductible: The amount a consumer pays for insured healthcare services before your insurance plan begins to pay. With a $1,000 deductible, for example, you are responsible for paying the first $1,000 of the services covered. An annual deductible can vary from one health insurance plan to the next. Also referred to as medical deductibles.

Health Insurance Premium: The monthly total you pay for health insurance. Additional costs for healthcare include annual deductibles, copays, and coinsurance.

In-network: In-network describes healthcare providers who are included within a health plan’s network of providers with which it has negotiated a discount.

Itemized bill: Details the medical services and procedures you are being charged for, including specifics on medications, inpatient stays, procedures.

The No Surprises Act: The Federal Trade Commission (FTC) states, “The No Surprises Act seeks to protect consumers from surprise medical bills arising out of certain out-of-network emergency care.”(11)(12).

Out-of-network: This refers to doctors, physicians, hospitals, or other healthcare providers who have not signed contracts agreeing to accept an insurer’s negotiated prices. They do not participate in the insurance provider’s network.

Medicare: Medicare is the federal government’s health insurance program which covers people age 65 or over, to meet hospital, medical, and other healthcare costs. It also covers younger people receiving specific disability benefits.

Medicaid: Public health insurance providing healthcare to low-income individuals and families, funded by individual states and the federal government. More information on Medicaid eligibility can be found here (13).

Medical Debt Forgiveness: For hardships such as a disability or serious illness that prevents you from working, hospitals or healthcare providers may agree to medical debt forgiveness. In these cases, the entire medical bill may be written off by the hospital.

Surprise Medical Bills: A surprise medical bill is an unexpected bill from a healthcare provider or facility. Surprise medical bills occur when part of a patient’s treatment isn’t covered by their health insurance plan. Surprise bills can happen in emergency and non-emergency care.

Public health insurance provided healthcare to low-income individuals and families, funded by individual states and the federal government.

Frequently Asked Questions About Expensive Hospital Bills

- heart valve replacement: $170,000

- heart bypass: $123,000

- spinal fusion: $110,000

- hip replacement: $40,364

- knee replacement: $35,000

- angioplasty: $28,2000

- hip resurfacing: $28,000

- gastric bypass: $25,000

- cornea: $17,500

- gastric sleeve: $16,000